value appeal property tax services

Partner with property owners to protest property tax valuations. And conveniently we also offer free property tax appeal evaluations too.

Property Tax Appeals Process Property Tax Tax Property

Conduct property tax valuation hearings on the clients behalf.

. Filing a successful property tax appeal results in an average savings of 1346 per year. Particularly if you live in a high-value market like California and New York or a state with high property taxes like Texas and Illinois. We monitor your property values applying our knowledge of acceptable.

Conduct uniform and equal analyses to ensure property tax assessments are fair and equitable. Commercial Industrial and Residential Our Property Tax Consultants work hard for you. They give you options to view comps neighborhood etc as well as assessment protest button you dont need any pins account s or secret keys.

At NTPTS we believe that your property taxes should be equitable and based on the true value of your property. Have a Logical Case for Your Grievance. And this property tax appeal income stream is.

Parties who waive their right to further appeal before the board and waive their right to petition for reconsideration will receive an expedited final certificate of value from the State Board of Equalization. We Create a Valuation Report If our value conclusion is lower than the assessed value by an. This way you can easily reference this information later on when it comes time to formally appeal your property value assessment with your local municipality.

Property tax appeal procedures vary from jurisdiction to jurisdiction. We send an Assessment Roll to Nova Scotias 49 municipalities by. We dont want you to pay more property taxes than you should be.

This is where property tax appeal services can come in handy. The assessor must enroll the lessor of the two. You can appeal and ask for a new one.

If you believe your appraised property value is substantially higher or lower than the price for which it could have reasonably sold on January 1 2019 you have the right to appeal. In addition to our appeals service we provide personal property form filing and property tax management services. They can help you assess the true value of your home and file an appeal to reduce your property taxes.

18 Years Property Tax Reduction Experience. If you feel like your tax payments have become too much to bear DoNotPay can help you understand how to lower them in a blink of an eye. You shouldnt depend on your ability to fool people into giving you an appeal for your property tax assessment.

We do a Preliminary Assessment Appeal Evaluation to determine your case value Saves You Time and its free. Licensed Real Estate Appraiser. As an Atlanta based property tax consultant for the past 18 years Daniel has developed the relationships that produce tax saving.

Our service includes the following. Successful residential property tax appeals are both data and relationships driven. In Cook County Illinois for example you can file an appeal online by following these steps.

A buyer that purchased a home in 2007 for 500000 would have a factored base year value of 500000 2 for each successive year. Tax Advantage Property Services LLC TAPS is a Charlotte North Carolina-based consulting firm focused on minimizing property taxes for commercial properties located in North Carolina and South Carolina. Were proud of our thousands of happy customers who regularly use our easy no stress service.

Appeal Here Denver makes it very easy for you to appeal your property tax value. The Trouble With Property Taxes in the US. File an appeal with your county assessors office Parrish said.

Parties who wish to settle a disputed assessment may submit an agreed order in which they stipulate the value of the property under appeal. Even if you cant appeal your taxes now we will email you when you when an appeal becomes available. Refer to your local county assessor for details on how and when you are required to file your appeal.

The website should be clearly marked on your notification letter. Residential Tax Appeal Services. Taxable value of real property is determined by the Factored Base Year Value or current market value as of January 1 of that tax year.

File the clients annual protests of property tax valuations. Simply go their website and search for your property address. We provide the following services.

Property Valuation Services Corporation PVSC is an award winning independent not-for-profit organization that is responsible for assessing all property in Nova Scotia. Provide an email address. We analyze the information and compare your assessed value to our value conclusion.

By John Cook on October 15 2013 at 932 am October 15 2013 at 949 am. ValueAppeal shuts down property tax appeal service changes focus to MoneyBall for real estate agents. Property tax appeal services can be exceptionally lucrative.

We provide residential tax appeal services specializing in high-end residential properties in Dallas Collin Denton and Tarrant counties. Durham Countys most recent reappraisal of real property was effective January 1 2019. We always provide a no upfront fee policy.

31 Years Real Estate Valuation Experience. As soon as you receive your proposed property tax notification check your municipal or county tax assessors website to learn what you need to do next. Contact us at 1-800-380-7775 or inquirypvscca to speak with an Assessor or schedule an appointment.

Check Your Property Tax Assessors Website. Put our 25 years of Property Tax Knowledge Experience and Refund expertise working to save you money on your Property Taxes. More information about the reappraisal and appeal processes is located at 2019 General Reappraisal Revaluation.

Four Important Key Points To Lower Hotel Property Taxes Property Tax Property Property Values

Best Payslips Service In Uk In 2022 Number One Service 20 Years

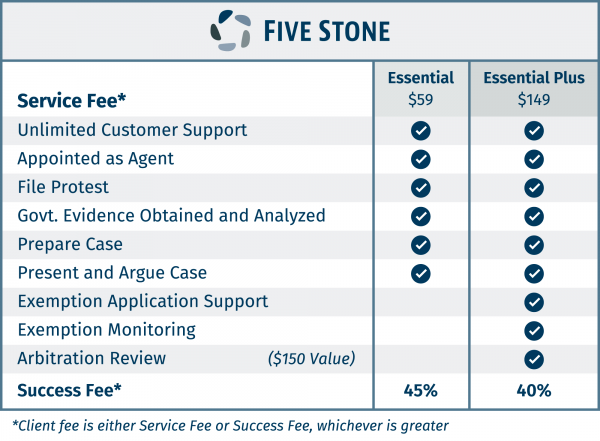

Residential Five Stone Tax Advisers

What Are The Requirements When Getting An Ein Tax Season Tax Time Capital Gains Tax

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Forms Real Estate Checklist Real Estate Tips

Property Tax Appeals When How Why To Submit Plus A Sample Letter

![]()

Property Tax Advisory Services Deloitte Us

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real Estate Agent Real Estate Deduction

Hotel Property Tax Consultant Springville Property Tax Commercial Property

Residential Property Tax Protest Services Swbc

Commercial Property Tax Solutions Corelogic

Secured Property Taxes Treasurer Tax Collector

![]()

Property Tax Advisory Services Deloitte Us

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Property

Property Tax Appeal Appeal Property Tax Property Tax Appeal Houston Property Tax Appeal Texas Property Tax Appealing Tax

Hotel Property Tax Consultant Property Tax Tax Reduction Tax

Need Help Fighting Your Property Taxes Have You Signed Up For Our Free Seminar In The Woodlands Yet Ken Property Tax Selling Real Estate Real Estate Buying

Which Services Provide A Payslips Company In 2022 National Insurance Number Service To Focus